I believe it was William Blake who said “hindsight is a wonderful thing, but foresight is better”.

Certainly, when you’re supporting clients buying energy, foresight would be a highly-desirable – although sadly never guaranteed – ability to have.

Hindsight, on the other hand, is far more attainable – and can be very useful for assessing what’s happened in the energy market and why. It may even help us develop greater foresight, if we can learn from events.

So I thought it would be interesting to look back at what our Optimisation Desk predicted for Summer (2024) – and then what actually occurred. You can also sign up for more analysis of the key drivers to watch out for as we approach the colder season.

Top-line prediction

The outlook for Summer 2024 looked to be fairly favourable, albeit with some risks. But overall, it was hoped positive factors would subdue prices, certainly compared to the previous two summers. But what happened?

It turned out to be more eventful than initially expected, which was reflected in increased volatility in gas and power prices. And while prices remained lower than the previous two years, they were above the long-term average.

This was driven by several factors, which aligned with the risks that were highlighted in our Optimisation Desk Summer 24 Outlook.

Summer’s main risks

The biggest factors identified were global liquefied natural gas (LNG) demand – especially in Asia – heatwaves and geopolitical issues. But how did these play out?

A major driver for the uptick in global gas prices over the summer was the escalation in geopolitical tensions in the Middle East and in Ukraine/Russia. This reinforced fears of supply disruptions, which created negative price impacts.

LNG supply was also affected by outages at large LNG facilities such as at Freeport in the US, which returned to full operating capacity over the summer after prolonged maintenance.

However, when Hurricane Beryl hit the Texas coast on 8 July, bringing large-scale disruption, Freeport had to shut down and then phase an operational return while repairing damage, reducing its July output by half. This outage influenced day-on-day shifts in European gas prices, causing increases of around 2%.

What about the weather?

As predicted, another key price driver over the summer was heatwaves.

Above normal temperatures were experienced globally, with China reporting the warmest-ever August, and record summer temperatures in Japan.

The northern hemisphere also reported the warmest summer on record, with August being the hottest in the National Oceanic and Atmospheric Administration (NOAA)’s 175-year climate record.

These high temperatures, especially in Asia, increased power use for cooling, resulting in robust LNG demand. Summer LNG imports to North East (NE) Asia were up 10% compared to 2023. This supported higher LNG prices over the summer.

Highlighting seasonal concerns

A continuing area of concern is summer maintenance for Norwegian gas assets and the French Nuclear fleet. Our Optimisation Desk expressed some nervousness around things going according to plan. And unfortunately, these doubts were partly founded.

The early summer Norwegian maintenance didn’t go as expected, with unplanned issues adding to scheduled outages. And while these weren’t as significant as in previous summer periods, gas prices did rise as a result.

Thankfully, routine maintenance to the French nuclear fleet went smoothly.

Did we call UK gas demand right?

We predicted gas demand was likely to remain low, due to reduced heating demand and the continued reduction in gas for power generation, as more renewable resources came online over the summer. Indeed, this turned out to be correct.

What about power demand?

While we forecast a small potential increase in power demand compared to the previous two summers, driven by the potential for higher industrial demand, we still expected overall levels to be below historic averages.

Levels did indeed remain below historic levels. But higher industrial demand didn’t materialise, so power demand continued in line with 2023.

What’s the situation as we enter Winter 24?

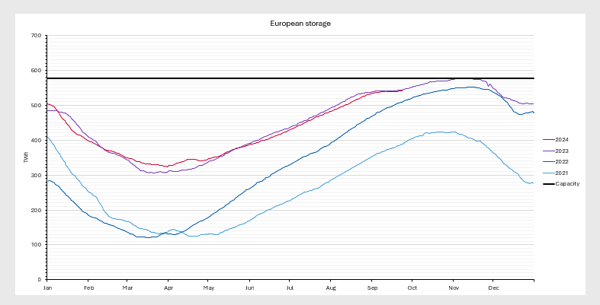

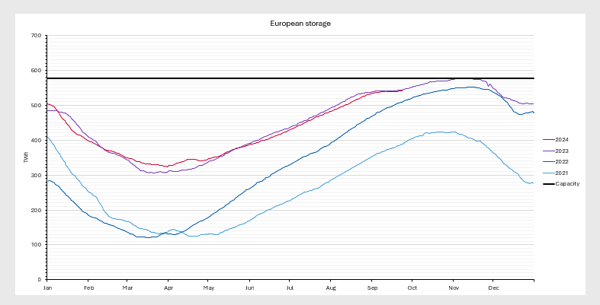

Gas storage levels are always a key focus when looking at potential price drivers for gas – and therefore power (as the two are so interconnected).

And while gas injection rates into European gas storage were a little slower over the summer compared to the previous year, they consistently kept pace with 2023 levels.

As of October, we’re currently at 94%, which is exactly where we need to be.

Looking forward, we’ll be sharing more analysis of the key drivers to watch as we approach the colder season – as well as predications for where prices may be heading – in our forthcoming Winter 24/25 Outlook. This will be released next month.

/npm214%20Digital_H_UB110.jpg)

/npm214%20Digital_H_UB141.jpg)

/npm214%20Digital_H_UB101.jpg)

/npm214%20Digital_H_UB132.jpg)

/npm214%20Digital_H_UB100.jpg)

/npm214%20Digital_H_UB136.jpg)

/npm214%20Digital_H_UB145.jpg)

/Author%20Profile%20Rafferty_Ellen_G.png)