Over the past year, we have seen unprecedented price rises in the wholesale gas and power markets, which is having a major impact on UK businesses trying to manage risk during uncertain times.

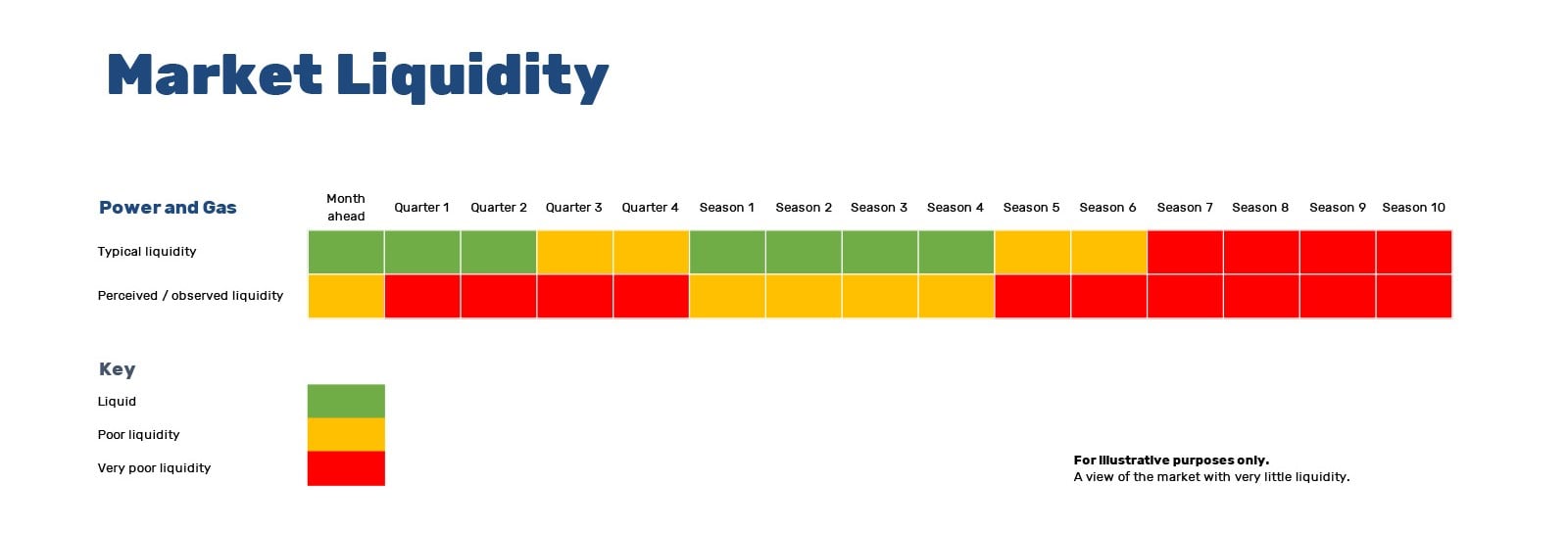

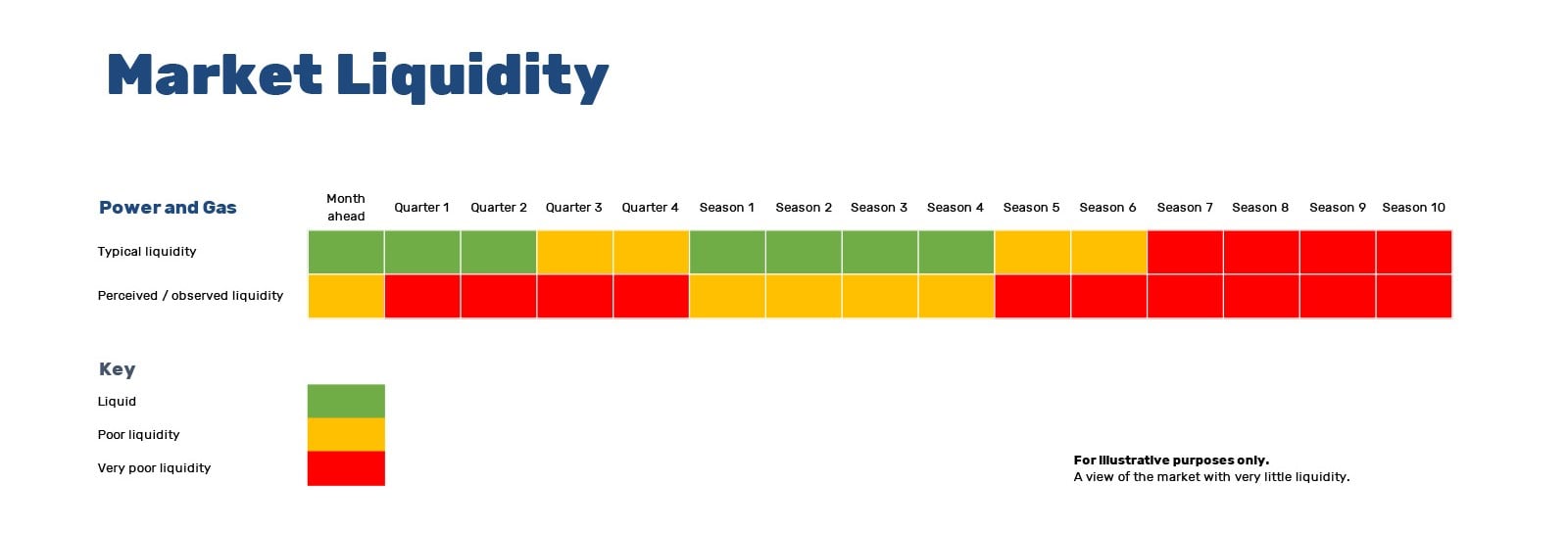

This increased volatility is also impacting the liquidity of the energy markets, with it becoming increasingly difficult to trade effectively and with minimal risk.

But what do we mean by liquidity? And why is it important?

Trading in troubled times

All energy suppliers source their products through the wholesale market, which works on the concept of willing buyers and sellers. This gives us the ability to buy the power and gas required by businesses at a fair and sensible price. In short, an efficient, well-functioning market is liquid.

However, when there is a lack of liquidity, it has a major impact on trading and the ability to buy the energy we need. This means suppliers have to buy at higher prices because there is a lack of volume available in the market. Similarly, sellers would say that liquidity is poor because there are not enough people trying - or willing - to buy.

What we're seeing now is a severe lack of liquidity and volume in the market. This is particularly true in the power market, which traditionally struggles more than gas. However, looking out to the next few quarters, the gas market will also see severe liquidity issues.

What is causing liquidity issues?

The current volatility has resulted in a reticence to trade in a highly unpredictable and fast-changing market. We are trading volumes where prices are moving 10 times more than they usually do - as it naturally brings additional risk with it.

However, while we are currently seeing a real deterioration in liquidity across both power and gas, this is not a new issue - it is something that has been steadily happening over the past 18 months. We, along with other energy suppliers, have been lobbying Ofgem to urgently reform the UK power market liquidity to protect the industry and ensure businesses are getting fair prices for their energy.

Cash liquidity also has an impact

When we’re talking about trading energy, there are two types of liquidity. The first is the volumes of power and gas and the second is cash liquidity. Both are important when it comes to looking at the impact on how business customers procure their energy, and the price they pay.

For example, if we look at margining - where trades take place via an exchange - the constant changes in the market mean that energy companies are having to seek additional funds to cover margin calls.

It is now such a concern, that last month, The European Federation of Energy Traders (EFET) called for the creation of a time-limited emergency liquidity support system. It said that “Massive price movements on European energy Exchange markets have resulted in massively increased margin requirements for market participants” and that “since the end of February 2022, an already challenging situation has worsened and more energy market participants are in a position where their ability to source additional liquidity is severely reduced or, in some cases, exhausted.”

All of this adds to the volatility in the market.

How is this impacting prices?

In short, the current and forecast liquidity situation is making the process of buying energy more difficult. In a well-functioning market, it is possible to guarantee the volume that can be bought. However, at the moment, it is increasingly difficult to make those guarantees. For example, a price can be agreed with a customer, but there is no guarantee where and how that volume will be purchased, and if it can be bought at that price.

Therefore, during times of increased liquidity issues, what customers pay for their energy will also factor in market risk. Similarly, benefits are passed through if the markets improve.

What can you do now?

With liquidity set to be an ongoing issue, there are several ways to reduce risk during volatile times:

- Consider your contracts - now more than ever it is important to review your purchasing strategy to ensure it reflects the current level of risk appetite and that electricity and gas budgets are realistic in the current climate. This is where we can help - we are in the market so have access to live information on liquidity.

- Maximise energy efficiency - it goes without saying that the less energy you use, the less you will pay. The recent crisis has brought the importance of energy efficiency to the fore - it really is a no regrets action to take.

- Become more self-reliant - investing in sustainable on-site generation has multiple benefits, not least making your organisation less reliant on the grid. From solar to combined heat and power (CHP), there are a variety of options available to organisations who want to be more self-sufficient.

- Consult an expert - working with your energy partner to help you make a strategic plan is more important than ever.

For further information or support, please get in touch with your Client Lead or Account Manager in the first instance, or drop us an email at info@npowerbusinesssolutions.com

/npm214%20Digital_H_UB121.jpg)

/npm214%20Digital_H_UB15.jpg)

/npm214%20Digital_H_UB127.jpg)

/npm214%20Digital_H_UB110.jpg)

/npm214%20Digital_H_UB141.jpg)